Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

5|0 comments

Tech's "Parallel Universe": Rally or Reprieve?

Market Musings: Tech's Triumphant Tango with Tumbling Treasury Yields The market's been doing a funny dance lately. We've got the S&P 500 attempting a graceful recovery, even as the Dow stumbles like a drunk at a wedding. The Nasdaq, bless its heart, is trying to lead the way, but the whole scene feels a bit…fragile. The Magnificent Seven tech stocks are back in the spotlight, but beneath the surface, there's a tug-of-war between optimism and the cold, hard data. What's driving this market schizophrenia? A few factors, all wrestling for dominance. First, there's the "hawkish Fed pivot" (as the financial press likes to call it). The market had priced in a December rate cut like it was a sure thing. Now, with Fed officials sounding less dovish than a flock of hawks, those expectations are getting brutally repriced. The probability of a cut next month has cratered from 70% to 48% in a week—a seismic shift in market sentiment. Then, there's China. Weak industrial production numbers (up just 4.9% year-over-year, the smallest increase in 14 months) and plummeting new home prices (-0.45% month-over-month, the biggest drop in a year) are casting a long shadow over global growth prospects. It's hard to ignore the elephant in the room: the world's second-largest economy is showing cracks, and that's bad news for everyone. But here's where things get interesting. Despite the Fed jitters and China worries, the Magnificent Seven are staging a comeback. Nvidia, Tesla, Microsoft, Apple, Meta, and Amazon are all showing signs of life. Energy producers are also riding high, thanks to a surge in WTI crude oil prices (up more than +2%). It's as if these sectors are operating in a parallel universe, immune to the macro headwinds. Stocks Recover on Strength in Megacap Tech and Energy Producers This divergence raises a crucial question: are these rallies justified, or are they simply a temporary reprieve before the inevitable reckoning? Are investors too focused on short-term gains, ignoring the long-term risks?Bitcoin Blues vs. Earnings Euphoria: A Market Disconnect

The Bitcoin Breakdown and Earnings Escapades The cryptocurrency market is offering a stark contrast to the tech exuberance. Bitcoin is down more than -2% at a 6.25-month low, extending a five-week-long sell-off. The king of crypto has shed -24% from its record high last month, and Bitcoin ETFs are seeing massive outflows (around $870 million on Thursday alone). It seems the "digital gold" narrative is losing its luster, at least for now. Meanwhile, the Q3 earnings season is winding down, and the numbers are surprisingly good. According to Bloomberg Intelligence, 82% of S&P 500 companies have exceeded forecasts, on track for the best quarter since 2021. Earnings rose +14.6%, more than doubling expectations of +7.2% year-over-year. But here's the rub: how much of this growth is sustainable? Are these companies genuinely thriving, or are they simply benefiting from temporary factors like pent-up demand and government stimulus? And this is the part of the report that I find genuinely puzzling. How can earnings be so robust when economic indicators are flashing warning signs? Are analysts underestimating the risks, or are they seeing something that the rest of us are missing? Let's look at some individual stock movers. Stubhub Holdings is getting hammered (down more than -24%) after reporting a massive Q3 loss per share (-$4.27, way wider than the consensus of -$2.49) and failing to provide a forecast for Q4. Manitowoc is also in the doghouse (down more than -4%) after Wells Fargo Securities initiated coverage with an "underweight" recommendation and a price target of $9. These companies are facing real challenges, and their stock prices are reflecting that reality. On the flip side, Cidara Therapeutics is soaring (up more than +105%) after Merck & Co. agreed to acquire the company for about $9.2 billion—or, to be more precise, $221.50 a share. Avadel Pharmaceuticals is also jumping (up more than +20%) after receiving an unsolicited proposal from H. Lundbeck A/S to acquire it for $23 per share. These are classic acquisition plays, driven by strategic considerations rather than underlying business performance. The Market's Mirage The market's current state reminds me of a desert mirage. From a distance, it looks like a lush oasis, but as you get closer, you realize it's just a shimmering illusion. The Magnificent Seven and energy producers are creating a similar effect, masking the underlying weakness in the broader economy. The Fed's hawkish rhetoric and China's economic woes are real threats, and they can't be ignored. The S&P 500 is down -0.06%, the Dow is down -0.67%, and the Nasdaq is up +0.11%. The question isn't whether the market can sustain its current levels. The question is whether the underlying foundations are strong enough to support future growth. And based on the data, I'm not convinced they are. A False Dawn?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

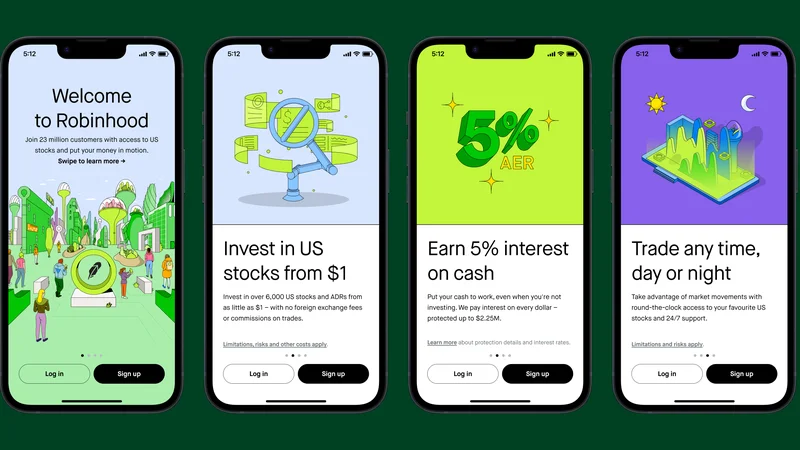

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

- Denied Access: The Truth About Crypto Analysis - Reddit's Take

- Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

- World Economy Fractures: The 'Danger' Is Already Reality. - Reddit in Shambles

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)