Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

5|0 comments

Fintech's ESG Reckoning: Greenwashing or Real Value?

The narrative around fintech is shifting. It's no longer just about disruption and user experience; it's about sustainability. Itochu's recent alliance with boost technologies, a firm specializing in ESG (Environmental, Social, and Governance) data visualization, signals a potential turning point. But is this a genuine commitment to sustainability, or just another wave of greenwashing riding the regulatory tide?

Itochu, a massive Japanese trading house, is partnering with boost to improve its ESG data collection. The stated goal is to build an efficient platform across 600 locations, both domestic and overseas, starting in 2025. The timing is interesting, given that Japan's Financial Services Agency will gradually mandate non-financial information disclosure in securities reports from the fiscal year ending March 2027. Coincidence? Maybe. But the pressure to demonstrate ESG credentials is undeniably mounting.

Sustainability Theater: Data Collection Doubts

The Data Collection Challenge Boost technologies offers the "booost Sustainability Cloud," an ERP system designed to handle ESG data collection, analysis, and reporting. They claim implementation in 180,000 locations across 80 countries. That's a broad footprint, but the key question is depth. How granular is the data, and how effectively can it be verified? (Self-reported sustainability data is notoriously unreliable.) Itochu plans to trial the system in 2025, aiming for efficient ESG data collection. The devil, as always, will be in the details. Itochu highlights its existing ESG initiatives, such as "business expansion with an eye toward a decarbonized society" and "strengthening human capital." These are broad statements. What specific metrics are they tracking? What's the baseline, and what are the targets? Without concrete data, it's difficult to assess the true impact. This is the part of the report that I find genuinely puzzling. Companies often tout these initiatives, but rarely provide the raw data to back them up.Itochu's "SX Field": Greenwashing or Real Change?

Beyond Compliance: Real Transformation? The partnership aims to provide decarbonization solutions and support for non-financial information disclosure. Itochu also intends to create new businesses in the "SX field" (sustainability transformation). This suggests a move beyond simple compliance. But what does "SX field" actually entail? Is it developing genuinely sustainable products and services, or simply relabeling existing offerings with a green veneer? Consider the sheer scale of Itochu's operations. They're involved in everything from textiles to energy to food. Visualizing the carbon footprint of such a diverse portfolio is a monumental task. Even with boost's technology, accurate and comprehensive data collection will be a significant challenge. And let's be honest, the mandatory disclosure rules are likely the real driver here, not some sudden surge of corporate altruism. Itochu's move is part of a larger trend. Fintech firms are increasingly recognizing the importance of ESG. As noted in Fintech 2025: New Waves of Innovation, Security, and User Experience, data-driven hyper-personalization is becoming table stakes. But applying that same data-driven approach to ESG is a different beast. It requires not just collecting data, but verifying its accuracy, assessing its materiality, and translating it into meaningful action. Can Itochu actually achieve that level of sophistication, or is this more about ticking boxes for investors and regulators? What will this partnership look like in 2030? Is This Just "ESG Theater?" Itochu's alliance with boost technologies is a potentially significant move, but the proof will be in the pudding. The success of this partnership hinges on the quality of the data, the transparency of the reporting, and the genuine commitment to sustainability transformation. Until we see concrete evidence of meaningful change, skepticism is warranted. The Data Will Tell the Real Story I've looked at hundreds of these partnerships, and this one feels like a mix of genuine effort and regulatory compliance. Itochu's size and influence mean this could be a catalyst for real change in the fintech world, or it could be another example of "ESG theater." The numbers, as always, will tell the real story.-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

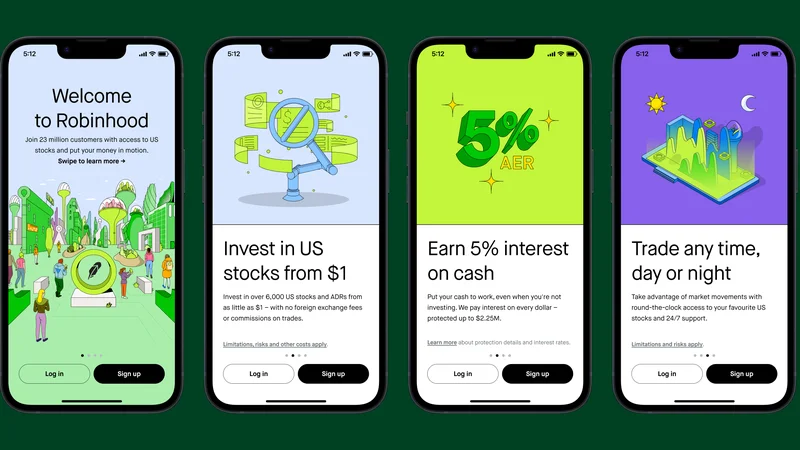

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

- Denied Access: The Truth About Crypto Analysis - Reddit's Take

- Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

- World Economy Fractures: The 'Danger' Is Already Reality. - Reddit in Shambles

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)