Why DeFi TVL Is Our Next Frontier - DeFi Boom Incoming!

7|0 comments

DeFi's Second Act: From Ashes to Innovation

The Phoenix Rises: DeFi Lending Roars Back Okay, folks, buckle up, because we're seeing something incredible unfold in the world of decentralized finance. Remember those dark days of 2022 and 2023? The crypto winter, the CeFi implosions… it felt like the whole lending market was on life support. Headlines screamed about the death of DeFi. But here's the thing about innovation: it doesn't die; it *adapts*.DeFi Lending: The Phoenix Rises Again!

DeFi Lending's Impressive Recovery And adapt it has. The latest data for Q2 2025 is in, and it's screaming one thing: DeFi lending is back, baby! Crypto-collateralized lending expanded by a whopping $11.43 billion, a 27.44% jump, to reach a total market size of $53.09 billion. That's not just a recovery; that's a resurgence. It's like watching a phoenix rise from the ashes, stronger and more vibrant than before.DeFi's Rise: A Victory for Decentralized Finance

DeFi's Dominance in the Lending Market But the *real* story isn't just the numbers, it's *where* that growth is happening. DeFi protocols now hold a dominant 59.83% of the crypto-collateralized lending market. CeFi? Well, they're still licking their wounds, hampered by regulatory pressures and the lingering stench of past scandals. This isn't just about DeFi surviving; it's about DeFi *winning*.DeFi's Evolution: Smarter Protocols, Real-World Assets

Key Factors Driving DeFi Growth And what's fueling this rocket ship? A few key things. First, DeFi protocols are getting *smarter*. Upgrades to platforms like Aave and Compound have drastically improved liquidation and risk management efficiency. They're learning from the past mistakes and building a more robust, resilient system. Second, we're seeing the rise of tokenized real-world assets (RWA) as collateral. Think of it: government bonds, real estate, commodities all finding their way into the DeFi ecosystem. This is bridging the gap between the old world and the new, creating a truly global, interconnected financial system.DeFi's Unwavering Spirit: $48 Billion Strong!

The Resilience of the DeFi Community The other thing that excites me is that the DeFi community is proving its resilience. We’ve seen the TVL in DeFi lending go from almost $0 in January 2020 to nearly $50 billion as of January 2025. Even now, after all the ups and downs, we're still holding strong at around $48 billion. That’s not just numbers, that's a testament to the power of a decentralized, community-driven system.Democratizing Dollars: A More Accessible Financial Future

Building a Better Financial Future But, let's be clear, this isn't just about making money, it's about building a better financial future. One that's more accessible, transparent, and equitable for everyone. What this means for us is… but more importantly, what could it mean for *you*?DeFi's Promise: Innovation Tempered by Responsibility

Challenges and Risks in DeFi However, this isn’t without its challenges. We need to be vigilant about security; with crypto thefts surpassing $2 billion in the first half of 2025, the risks are real. And we need to ensure that this growth benefits everyone, not just a select few. It's about building a system that’s not only innovative but also ethical and responsible.DeFi: A Glimpse into a Radically Fairer Future

The Transformative Potential of DeFi When I first saw these numbers, I honestly just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place. It's not just about technology; it's about the potential to transform lives.DeFi: Building the Internet of Value, Brick by Digital Brick

DeFi: The Internet of Value This resurgence isn't just a blip on the radar; it's a sign of a fundamental shift in how we think about finance. DeFi is becoming the internet of value, a permissionless, borderless system that's open to anyone with a smartphone and an internet connection.DeFi Lending: The Numbers Don't Lie—It's Exploding

DeFi Lending Statistics and Trends Just look at the numbers: DeFi borrowing in Q4 2024 stood at $19.1 billion, nearly double the CeFi figure. Ethereum dominates in DeFi lending supply, holding around 80.97% share as of May 2025. And Aave *alone* increased its TVL in Q2 2025 by 52%, outpacing the broader DeFi growth of ~26%. The momentum is undeniable. For more insights into the future of DeFi, check out Top 5 DeFi Trends for 2024-2026.DeFi's Resilience: Forging a Secure Path Forward

Addressing Risks and Building a Resilient System What about the risks? Of course, there are risks. Flash loan attacks, oracle manipulation, regulatory uncertainty… these are real challenges that need to be addressed. But the DeFi community is tackling these head-on, developing innovative solutions and building a more secure, resilient system.DeFi: Echoes of the Internet Revolution?

DeFi: A Paradigm Shift in Finance It’s like the early days of the internet. Remember all the doubters who said it was just a fad? They couldn't imagine a world where we could instantly connect with anyone, anywhere, access information at our fingertips, and conduct business across borders. Well, DeFi is that same kind of paradigm shift, but for finance. It’s not just about replicating the old financial system; it’s about creating something entirely new, something better.DeFi: Building a More Just and Equitable World

Empowering Individuals and Creating Opportunities And that’s why I’m so excited about the future of DeFi. It's not just about the technology; it's about the potential to empower individuals, create new economic opportunities, and build a more just and equitable world.DeFi's Rise: Thriving, Innovating, Empowering

A Revolution in Progress So, what does this all mean? I think it’s clear: DeFi is not just surviving; it’s thriving. It’s learning from its mistakes, innovating at a breakneck pace, and building a more robust, resilient system. And most importantly, it’s empowering individuals and creating new economic opportunities.DeFi Lending: An Explosion of Financial Freedom?

Projected Growth of the Crypto Lending Market The crypto lending market is projected to grow at a 22.6% CAGR from 2025 to 2033. Think about that. That's not just growth; that's an explosion. And DeFi is poised to lead the charge.DeFi: More Than Money, a Blueprint for Tomorrow?

Building a Better Future with DeFi This isn't just about making money; it's about building a better future. I know it sounds cliché, but it's true. DeFi has the potential to transform the world, and I, for one, am incredibly excited to be a part of it.html DeFi: A Glimpse of Finance's Limitless Horizon?

DeFi: A New Dawn

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

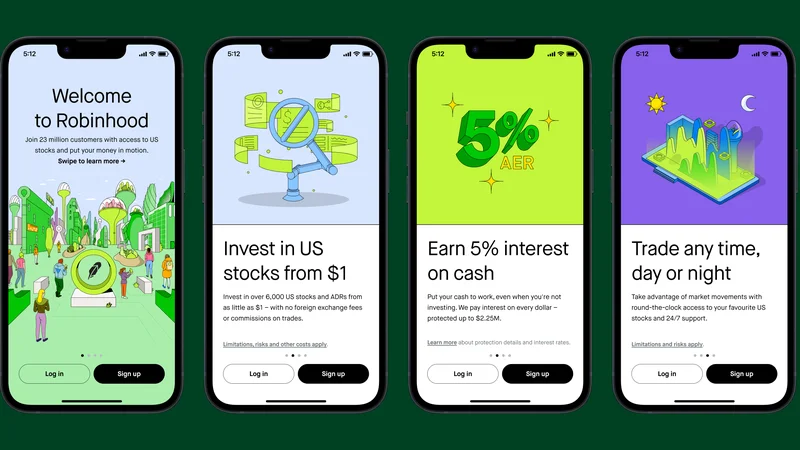

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Why Crypto Analysis Is a Joke (r/Crypto)

- Why Crypto's Slide Is Our Greatest Opportunity - Reactions Explained

- Asia Stocks Mixed on Fed Cut Bets: The Fed's Game and What It Means for GDP

- DeFi's 2025 'Recovery': Same Old Scam. - Investors React

- DeFi Post-Crash: The Data Shows a False Recovery - Twitter Meltdown

- Asian Shares Advance After Wall Street Retreat: What's the Catch?

- Why DeFi TVL Is Our Next Frontier - DeFi Boom Incoming!

- Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

- Denied Access: The Truth About Crypto Analysis - Reddit's Take

- Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)