Asia Stocks Mixed on Fed Cut Bets: The Fed's Game and What It Means for GDP

8|0 comments

Okay, so Asia's stock markets are doing the cha-cha slide again. One minute they're up, the next they're down. What's the deal? Apparently, it all boils down to the U.S. Federal Reserve and whether or not they're gonna play Santa Claus with interest rates.

Fed Pivot Hopes: Asia's Wild Ride, Australia's Gaslighting

The Fed's Maybe-Maybe-Not Pivot The market's all hopped up on the idea that the Fed's gonna cut rates soon. Like, any day now. The odds of a rate cut have supposedly skyrocketed, which sends Japan and South Korea into a frenzy. Everybody else? Eh, not so much. Singapore's inching up, India's taking a nosedive, and China and Hong Kong are basically shrugging. Asia stocks mixed as Fed cut bets lift Japan, S.Korea; Australia Q3 GDP in focus By Investing.com And Australia? Don't even get me started. Their GDP numbers are a mixed bag of nuts. Sure, annual growth looks good, but the quarterly numbers are weaker than my morning coffee. It's like they're trying to gaslight us with economic data. Strong growth, but uncertainty about monetary easing? Give me a break. Which is it? But let's be real: the Fed's track record ain't exactly stellar when it comes to clear communication. One day they're hawkish, the next they're dovish. It's enough to give anyone whiplash. So, while the market's pricing in a rate cut, I'm not holding my breath. These "market participants" are probably the same clowns who thought crypto was a safe investment.China's "Roaring Comeback": More Like a Sputtering Engine

China's Slowdown Blues Speaking of things to worry about, let's talk about China. A private survey is showing that their service sector is slowing down. New orders are down, job losses are still happening, even if exports are doing slightly better. Here's the translation: China's economy is still sputtering. All this talk about a roaring comeback? Smoke and mirrors, people. Smoke and mirrors. And the Nikkei hitting record highs? That's just a sugar rush from a Prime Minister resigning. It’s like when your sports team fires the coach and suddenly plays well for a week. It doesn’t mean anything long term. I mean, seriously, are we supposed to believe a change in leadership instantly fixes everything? I’m starting to think the whole world is just making stuff up as they go along.Australia's Economy: A Choose-Your-Own-Disaster Novel

Aussie Headaches Australia's GDP is like a choose-your-own-adventure novel. You can spin it however you want. Did the economy grow or not? Yes, but also, no. It grew annually, but not quarterly. Household consumption and business investment were firm, but inventory dragged things down. It's like trying to assemble IKEA furniture with missing parts. Is it functional? Sort of. Is it pretty? Absolutely not. The "relatively strong" data throws a wrench into any plans for near-term monetary easing by the Reserve Bank of Australia. So, basically, they're stuck between a rock and a hard place. Do they ease and risk fueling inflation, or do they stay put and risk choking off growth? The RBA probably has no idea what to do next. Do I have a better idea? Offcourse I do. But does anybody ask me? No. So, What's the Real Story? It's all a big, fat mess. The Fed's gonna do what the Fed's gonna do, China's gonna keep chugging along at its own pace, and Australia's gonna keep trying to convince us that everything's fine when it's clearly not. Buckle up, folks. It's gonna be a bumpy ride.-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

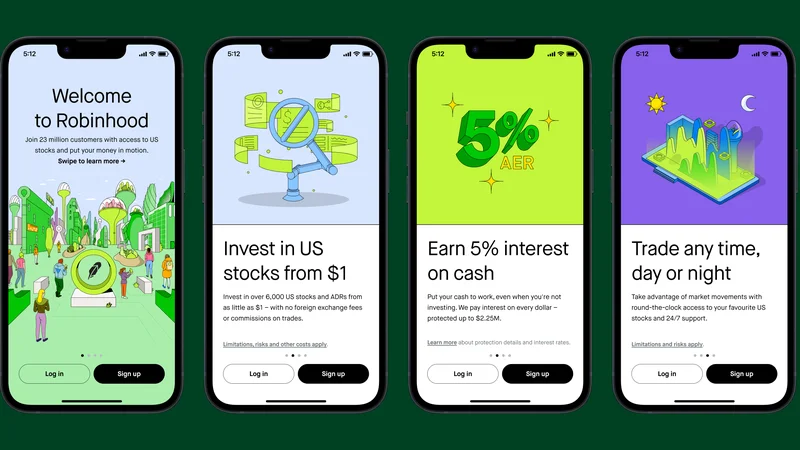

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Why Crypto Analysis Is a Joke (r/Crypto)

- Why Crypto's Slide Is Our Greatest Opportunity - Reactions Explained

- Asia Stocks Mixed on Fed Cut Bets: The Fed's Game and What It Means for GDP

- DeFi's 2025 'Recovery': Same Old Scam. - Investors React

- DeFi Post-Crash: The Data Shows a False Recovery - Twitter Meltdown

- Asian Shares Advance After Wall Street Retreat: What's the Catch?

- Why DeFi TVL Is Our Next Frontier - DeFi Boom Incoming!

- Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

- Denied Access: The Truth About Crypto Analysis - Reddit's Take

- Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)