Why Crypto's Slide Is Our Greatest Opportunity - Reactions Explained

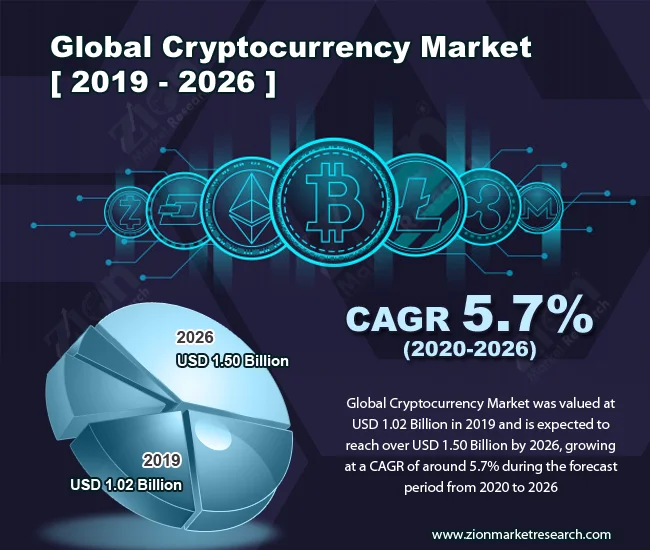

Alright, folks, buckle up. If you thought 2024 and 2025 were wild rides in the crypto world, just wait until you see what 2026 has in store. We're not just talking about incremental changes here; we're talking about a fundamental, tectonic shift in the landscape. It's like watching the continents realign – slow at first, then BAM! Everything’s different.

The Crypto Revolution of 2026

The Perfect Storm: Regulation, Institutional Money, and Tech

What’s driving this? A confluence of factors that are finally starting to click into place. First, regulation. For years, the Wild West nature of crypto has scared off serious institutional investors. But now, we're seeing real, concrete regulatory frameworks emerge across the globe, from the US's GENIUS Act to the EU's MiCA rollout. This isn't just about compliance; it's about creating a safe, predictable environment where big players feel comfortable deploying massive capital. And guess what? They're ready to pounce.

The Global Crypto Policy Review Outlook 2025/26 Report is crystal clear: regulatory clarity is fueling institutional adoption. About 80% of the jurisdictions they reviewed saw financial institutions announcing new digital asset initiatives in 2025. That's HUGE. It's like the dam has finally broken, and a tidal wave of institutional money is about to flood the crypto market. We're talking pension funds, hedge funds, sovereign wealth funds – the kind of money that can truly move the needle. And don't even get me started on the tech. The innovations in stablecoins, tokenization, and DeFi are creating entirely new use cases for crypto, making it more than just a speculative asset. It's becoming a fundamental part of the global financial system.

Mainstream Adoption: A New Era

Think about it: stablecoins reaching record highs, financial institutions engaging more with public blockchains… This isn't some fringe movement anymore. This is mainstream adoption, driven by a combination of regulatory clarity and technological innovation. It is like the early days of the internet – a period of experimentation and uncertainty, followed by a surge of innovation and adoption that transformed the world. Is it any wonder that Texas is now the first US state to publicly invest in Bitcoin? It's a symbolic move, sure, but it signifies a much bigger trend: the legitimization of Bitcoin as a mainstream asset. When I first read about Texas's move, I felt a surge of excitement. This is the kind of validation that can change everything.

The Ethical Imperative

But let's not get carried away. With great power comes great responsibility. As crypto becomes more integrated into the global financial system, we need to be mindful of the ethical implications. We need to ensure that this technology is used for good, not for ill. We need to protect consumers, prevent illicit activity, and promote financial inclusion. It’s a challenge, to be sure, but it’s one we can and must overcome.

Preparing for the Ride

What does all this mean for you? Well, if you've been sitting on the sidelines, now might be the time to jump in. But do your homework. Understand the risks. And most importantly, be prepared for a wild ride. Because 2026 is going to be a year of explosive growth in the crypto market, and it's going to be unlike anything we've ever seen before. I am truly optimistic about the possibilities before us.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

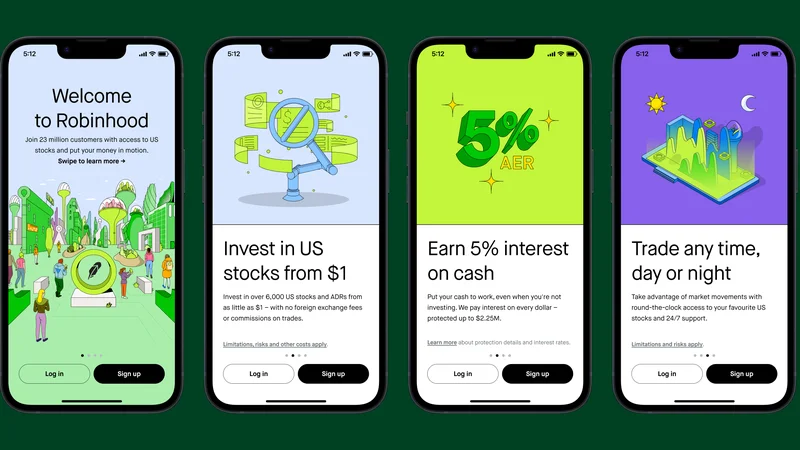

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Why Crypto Analysis Is a Joke (r/Crypto)

- Why Crypto's Slide Is Our Greatest Opportunity - Reactions Explained

- Asia Stocks Mixed on Fed Cut Bets: The Fed's Game and What It Means for GDP

- DeFi's 2025 'Recovery': Same Old Scam. - Investors React

- DeFi Post-Crash: The Data Shows a False Recovery - Twitter Meltdown

- Asian Shares Advance After Wall Street Retreat: What's the Catch?

- Why DeFi TVL Is Our Next Frontier - DeFi Boom Incoming!

- Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

- Denied Access: The Truth About Crypto Analysis - Reddit's Take

- Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)