DeFi Post-Crash: The Data Shows a False Recovery - Twitter Meltdown

6|0 comments

Alright, let's dissect this Cronos (CRO) situation. The marketing narrative is always "bright future," "compelling investment opportunity," but let's see what the numbers actually say after a year that, putting it mildly, didn't exactly set the world on fire.

CRO: Sideways Drifting in a Sea of "SELL" Signals

The State of CRO: Stuck in Neutral? We're looking at late November 2025 data. CRO is hovering around $0.107, which, let’s be honest, is a far cry from its all-time high of nearly a dollar back in November 2021. We see CRO remains confined to a narrow price range, staying between $0.1063 and $0.1092, signaling limited volatility and no clear direction. A 0.07% dip over 24 hours? That's not exactly instilling confidence. The technical analysis paints a picture of a token struggling to find momentum. Resistance at $0.109 seems pretty firm, and support at $0.106 is the only thing preventing further downside. The daily chart? “Flat structure,” “neutral momentum,” “indecision.” The 4-hour chart? “Slight downward leaning,” “range-bound,” “no clear breakout attempt.” It's like watching a stock stuck in a perpetual holding pattern, waiting for… something. And the moving averages? A whole lot of "SELL" signals across the board. The 50-day SMA is at $0.1363, and the 200-day SMA is at $0.1418 – both well above the current price (and both triggering sell signals). The price volatility? About 13.25% over 30 days, which, in crypto terms, is relatively tame but still indicates underlying instability. The question is, can Cronos break out of this rut? The reports suggest a close above $0.109 would be a positive sign, potentially opening the door for a short-term recovery. But if buyers can't manage that, the token is likely to keep drifting sideways, pinned down by selling pressure.Cronos: Hopeium or Data-Driven Growth?

Parsing the "Bright Future" Narrative The pro-CRO arguments hinge on a few things. First, there's the "Smarturn" upgrade completed in October 2025, which is supposed to boost EVM compatibility and scalability. Sure, that's great on paper, but is it actually driving adoption? The numbers aren't exactly screaming "mass migration to the Cronos chain." Then there's the whole Crypto.com ecosystem. The value of CRO, we're told, depends on the performance of the Cronos Chain, the adoption of the ecosystem, and the continued expansion of Crypto.com’s products and user base. But that’s the thing, isn’t it? It all hinges on Crypto.com continuing to execute and grow. And after the stumbles of 2022 and 2023, that's not a given. I've looked at enough of these reports to know that "long-term speculative asset" is often code for "we're not sure what's going to happen, but hope for the best." And this is the part of the report that I find genuinely puzzling. The projections for the future are… optimistic, to say the least. Cronos is expected to trade at a minimum price of $0.1265 and a maximum price of $0.1327 in 2025. The average trading price is expected to be around $0.1294. By 2031 it's supposed to have a maximum cost of $2.56, with an average price of $2.19. How do we get from a token struggling to stay above $0.10 to $2.56 in six years? What fundamental shift is going to drive that kind of growth? CRO price prediction 2025, 2026, 2027-2031 One could argue it is worth allocating to names with fundamental catalysts. On the buyback side, names like HYPE (-16% QTD) and CAKE (-12%) posted some of the best returns for larger market cap names in the cohort, indicating investors may be allocating to them or that their price has been supported by their substantial buybacks. It's like saying, "This stock is currently trading at $1, but we expect it to be worth $100 by 2030 because… reasons." The reasons usually involve a lot of hand-waving and vague promises about future innovation.CRO: Stuck in a Rut, Community Lukewarm

The Community Sentiment: A Mixed Bag What are people actually saying online? Well, it's a mixed bag, as always. There's the usual contingent of true believers who are convinced that CRO is going to the moon. But there's also a healthy dose of skepticism and frustration from people who bought in at higher prices and are now sitting on losses. Reddit discussions praise Solana’s speed and low fees, with bullish sentiment around institutional adoption and ETF prospects. But users are concerned about the network’s heavy reliance on meme coins. The community is split between those celebrating $78B USDT dominance and critics pointing to centralization concerns and Justin Sun controversies affecting credibility. X shows 51% bullish sentiment with #HYPEto100 trending, but critics raise serious decentralization concerns, initially only 4 validators (now 27), closed-source code, and transparency issues sparked a 15% dump in January when validator fairness questions emerged. I'm not saying online sentiment is the be-all and end-all, but it's a useful indicator of overall market perception. And right now, the perception of CRO seems to be somewhere between cautious optimism and weary resignation. The "Smart Money" is Staying on the Sidelines The bottom line? CRO is a token with potential, but it's also a token facing significant headwinds. The technical analysis suggests it's stuck in a rut, the fundamentals are promising but unproven, and the community sentiment is lukewarm. The projections for future growth seem overly optimistic, bordering on delusional. It is unlikely that Cronos’s price will reach $100, as this would require an extremely high market capitalization, surpassing the current CRO coin price prediction for the cryptocurrency sector. So, is CRO a "smart bet" after a rough 2025? My analysis suggests… not yet. It's a speculative play with a lot of question marks. Unless we see a significant shift in momentum, I'd recommend staying on the sidelines. Wait for the Breakout, Then Reassess

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

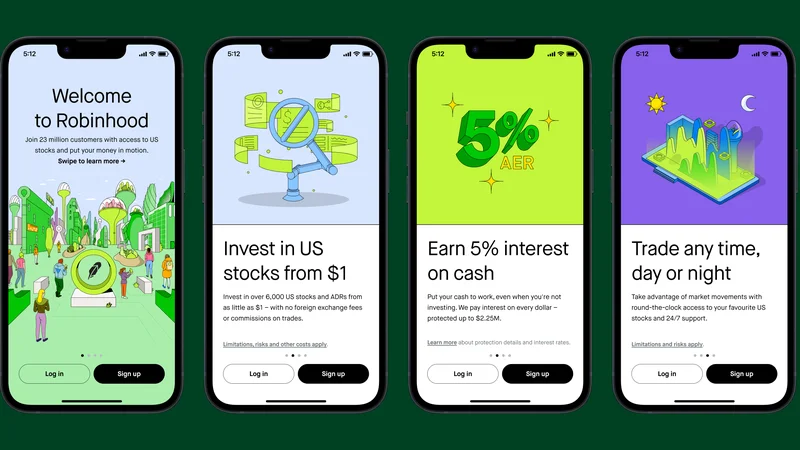

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Why Crypto Analysis Is a Joke (r/Crypto)

- Why Crypto's Slide Is Our Greatest Opportunity - Reactions Explained

- Asia Stocks Mixed on Fed Cut Bets: The Fed's Game and What It Means for GDP

- DeFi's 2025 'Recovery': Same Old Scam. - Investors React

- DeFi Post-Crash: The Data Shows a False Recovery - Twitter Meltdown

- Asian Shares Advance After Wall Street Retreat: What's the Catch?

- Why DeFi TVL Is Our Next Frontier - DeFi Boom Incoming!

- Fintech 2025 Outlook: Separating Hype from Data in Innovation, Security, and UX

- Denied Access: The Truth About Crypto Analysis - Reddit's Take

- Global Jitters: The Truth About S&P 500's Rise - r/Stocks Reacts

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)